can i get the child tax credit if my child was born in december

Find Reliable Business Tax Info Online in Minutes. The American Rescue Plan also provides families with the option to receive the tax credit monthly.

Canadian Children S Rights Council Conseil Canadien Des Droits Des Enfants Child Rights Canada Paternity Testing Paternity Fraud Child Rights And Dna Testing

During 2021 can claim the child tax credit.

. With the new addition I would expect the remaining 6900 for those 4 kids plus the 3600 for 5 for a total of 10500. Be under age 18 at the end of the year. Parents of any baby born in the US.

If instead your child is born in December then the entire 3600 credit will just be applied as a lump sum at tax season. It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Through the year I received half of the advanced CTC for the other children aged 9 5 4 2.

The payments are set to be distributed starting July 15th. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Your family could receive.

However TurboTax is closer to 7000. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Complete Edit or Print Tax Forms Instantly.

Taxpayers with babies born as late as December 31 may still claim the credit on their 2021 tax return if they meet certain requirements. Chat with a Business Tax Advisor Now. But since the credit became refundable more people became eligible in 2021.

If your baby was born any time in 2021 you are eligible to claim the credit. Home of the Free Federal Tax Return. Understand how the 2021 Child Tax Credit works.

The credit is fully refundable meaning that eligible families can get it in the form of a refund even if they owe no federal income tax. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. E-File Directly to the IRS.

The payments for July through September 900 total will be applied when you file taxes in 2022. Doing the math that was 1380026900 over the six months. Get the Child Tax Credit.

The Child Tax Credit will help all families succeed. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Ad Tax Strategies that move you closer to your financial goals and objectives. Families may qualify for a tax credit of up to 3600 if they had a baby in 2021. Child 5 was born Dec 3rd.

The Child Tax Credit for tax year 2021 is 3600 per child for qualifying children under the age of 6 and 3000 for qualifying children ages 6 through 17. Understand that the credit does not affect their federal benefits. The IRS has already started shutting down CTC which runs out on December 31.

Find out if they are eligible to receive the Child Tax Credit. Families could be eligible to get 205 for each. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

MapodileE via Getty Images The child tax credit is for taxpayers who claim a qualifying child as a dependent on their tax return. Before the CTC was only partially refundable meaning those below a. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return.

We provide guidance at critical junctures in your personal and professional life. Ad Access IRS Tax Forms. Normal CTC used to be up to 2000 for each child up to age 17 and parents would claim in yearly on their tax returns.

Talk to Certified Business Tax Experts Online. Does a baby born in 2021 qualify for child tax credit. The American Rescue Plan which I was proud to support expanded the Child Tax Credit to provide up to 3600 for children under the age of 6 and 3000 for children under the age of 18.

Ad 247 Access to Reliable Income Tax Info. Parents do not need to have earned income or a job to claim the credit. To be a qualifying child for the 2021 tax year your dependent generally must.

Here S The Truth About Vitamin K For Newborns

Homepage Save The Children Canada

Canadian Children S Rights Council Conseil Canadien Des Droits Des Enfants Child Rights Canada Paternity Testing Paternity Fraud Child Rights And Dna Testing

Russian Adoption Ban Will Hit Disabled Children Evangelical Christian Families Disabled Children Adoption Christian Families

Funny Boy Or Girl Birth Announcement Custom Digital Baby Photo Birth Announcement Funny Baby Funny Birth Announcements Birth Announcement Girl Funny Birth

Canadian Children S Rights Council Conseil Canadien Des Droits Des Enfants Child Rights Canada Paternity Testing Paternity Fraud Child Rights And Dna Testing

![]()

It Is In The Giving That We Receive Arizona Private Education Scholarship Fund Long Hair Styles Hair Styles Redheads

Homepage Save The Children Canada

Leading Your Child To Christ Focus On The Family

Overprotective Parents Causes Signs And Effects

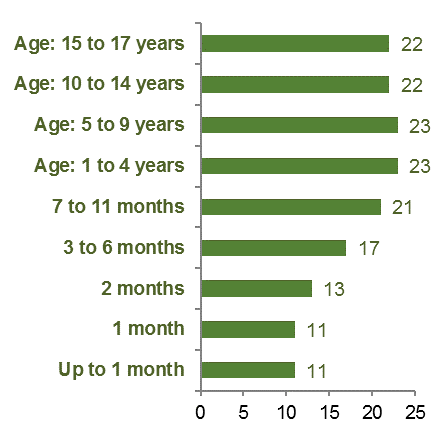

Evaluation Of The Employment Insurance Parents Of Critically Ill Children Benefit Canada Ca

China S Three Child Policy What Do The New Support Measures Say

Overprotective Parents Causes Signs And Effects

Leading Your Child To Christ Focus On The Family

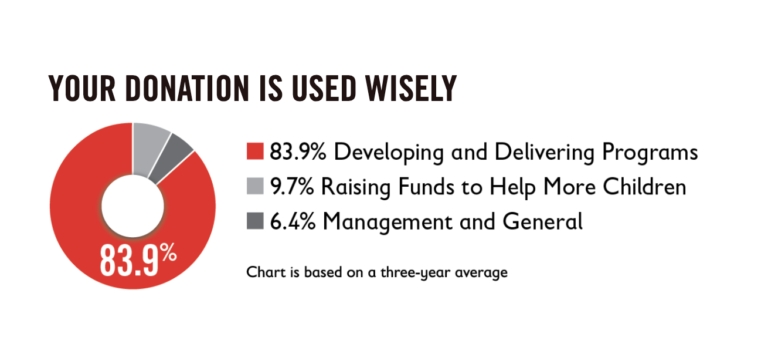

Homepage Save The Children Canada

How To Claim Child Tax Credits What Are Child Tax Credits Nolo

Homepage Save The Children Canada

Child Tax Credit 2022 Are You Eligible For Money From Your State Cnet